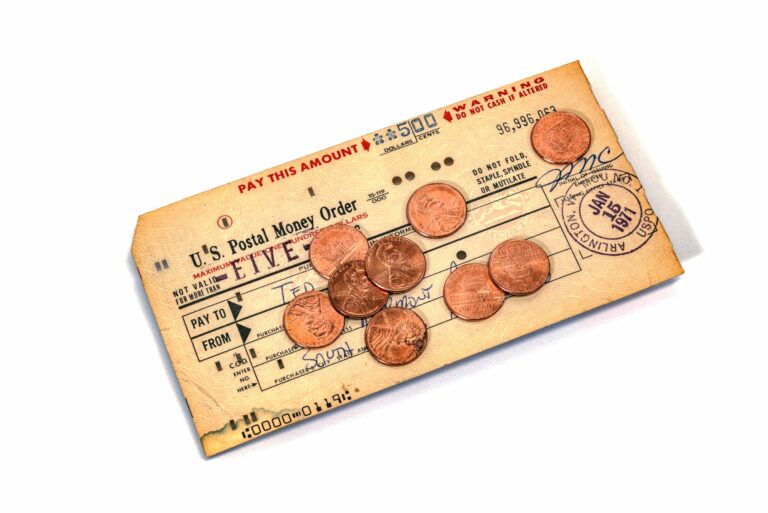

A money order is just like a check, except prepaid. This means it’s a safer form of payment than a personal check because there’s no risk it will bounce. And lots of different places cash money orders, including banks, post offices, and grocery stores.

You searched for

Safe Banks

12 articles

While you can’t avoid most of the costs associated with buying a house, you can at least avoid paying too much due to common first-time homebuyer mistakes. Learn how to sidestep these pitfalls and minimize your housing transaction costs.

You may have heard of coupon, rebate, and micro-saving and investing apps before. But apps specifically geared to the needs of college students give you access to the things you most care about saving money on. Find the best one for your needs.

A cashier’s check is a secured payment method backed by the full faith and credit of a bank. It’s great for situations that require large amounts of money, such as putting a down payment on a house. Learn how it works and how it’s different from a personal check.

GoHenry and Greenlight are two of the most popular prepaid debit cards for kids. Each has a host of features to empower your kids to control their own finances — with some supervision. Learn how these two products compare head-to-head to help you decide which is the best choice for your family.

It’s time to take control of your financial life. By getting your finances under control, you can give yourself a little breathing room in the short term and a chance to get ahead in the long term. These tips can help.

If the TV talking heads are talking about interest rates again, you’re probably wondering how that affects you. Learn how the federal funds rate affects your daily life and why they change it in the first place.

Electronic direct deposit is a common and convenient method of payment used by employers, government agencies, and everyone in between. Direct deposit is easier and safer than paper checks, so it’s past time for you to set it up if you haven’t already.

Having less-than-perfect credit closes some financial doors, but second-chance bank accounts are specifically designed for people with credit issues or other blemishes in their banking histories. Which of these options are the best? Learn about the best bank accounts for people with bad credit.

Your smartphone now serves many of the roles formerly played by physical payment cards in your wallet. Digital wallets and mobile payment technology are quickly replacing cash. Learn how they work and how to protect yourself when using them.

Foreclosure properties sometimes make great bargains — emphasis on “sometimes.” They can also come with hidden pitfalls and red tape in having to work with bureaucratic bank sellers. Learn how to buy a foreclosed home using the safest process to score a bargain on real estate.

For funds you’ll need to access in under one year, the stock market is too volatile and risky in the short-term—you need a place to park your money where it will be safe, but ideally can earn some returns. Learn the best short-term investments in which to park your money for less than one year.