Wealthfront was one of the first robo-advisor platforms to break into the retail investing mainstream and remains a popular choice today thanks to its low cost and well-rounded services. Read on to familiarize yourself with what Wealthfront is all about and how it stands apart from the competition.

You searched for

Early 401k Withdrawals

12 articles

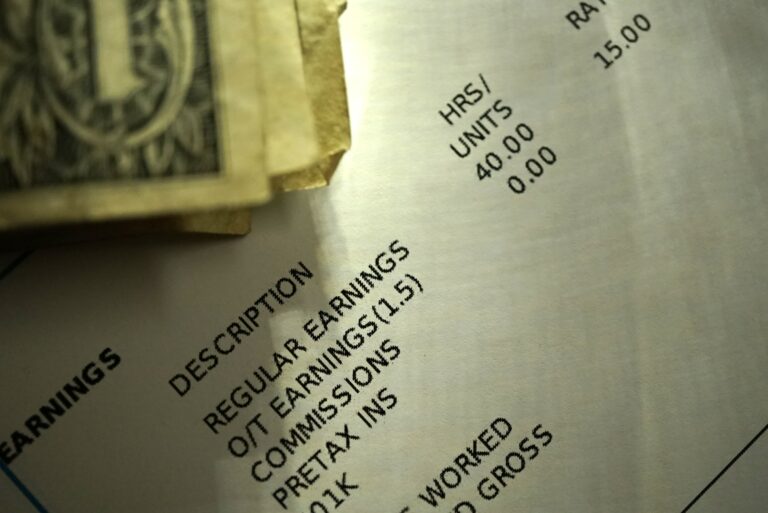

There are many occasions in which you may need to prove your income, whether you’re attempting to get a mortgage, auto loan, a new apartment, or a public welfare benefit. Read on to learn how to show proof of income from the most common income sources in a wide range of situations.

For many of us, our 60s are dominated by the transition to retirement. It’s one of life’s major transitions, right up there with moving out of our parents’ house or getting married. And it takes planning to get right. Consider these smart financial moves to make in your 60s.

When you reach your 50s, you can no longer afford the illusion that retirement is some far-distant concern for another day. You need to laser focus on long-term financial planning and begin adjusting your budget as you get older and your needs change. Learn the smart money moves to make in your 50s.

Turning 40 forces many of us to reluctantly admit to reaching middle age. In this midway decade of your life, it’s time to jettison remaining baggage from your childhood and young adulthood — emotional or financial — and start living your ideal life. Learn the smart money moves to make in your 40s.

Leaving a bad job may be the best way to change your life, but to quit your job without arranging a new one leaves you vulnerable to hardship. Before you quit your job without an offer for a new one, find out how to think through the implications and prepare yourself financially for the change.

Stash is a one-stop banking and investing platform that’s simultaneously DIY-friendly and relatively hands-off. It works best for reasonably confident investors looking to build custom portfolios from more than 1,800 ETFs and stocks. Find out if it’s right for you here.

With college costs on the rise, parents and students may be wondering how much they need to save. The amount depends on a variety of factors: the parents’ budget, school costs, and where the student wants to attend school. Learn more about savings methods like 529s and how much you should be saving.

When you’re hiring a financial advisor, it’s important to find the right person for the job. You need someone who’s competent and trustworthy — and preferably, someone who won’t charge you an arm and a leg. Ask potential advisors these questions to make sure you’re a good fit for each other.

Often considerations like age, high income, debt, and economic volatility might lock you into a current job and make a change seem too risky. Don’t let these obstacles hold you back from pursuing your dream job — here’s how to prepare yourself for a career change.

Too many 20-somethings chase higher incomes with no clear endgame — and spend every penny along the way, entering their 30s with no financial assets to show for it. Make these smart financial moves in your 20s and you’ll find better footing in every area of your life, not just your finances.

Acorns and Stash are micro-investing apps perfect for investors who want to dip their toes in the market with a little bit of cash at a time. Their offerings are similar, but each has subtly different features, pricing, and capabilities. Learn which is best for your financial goals here.