We accept the fact that things get more expensive over time because of inflation, but that’s not always the case. Although rare, certain economic conditions give rise to negative inflation, popularly known as deflation. Learn what deflation is, what causes it, and its effects on the economy.

You searched for

Buying Stocks

12 articles

Studies show that emotion undermines the average investor’s returns. But removing emotion from your investing decisions is easier said than done. Implementing these steps will help you combat the powerful emotional impulses that can wreak havoc on your returns.

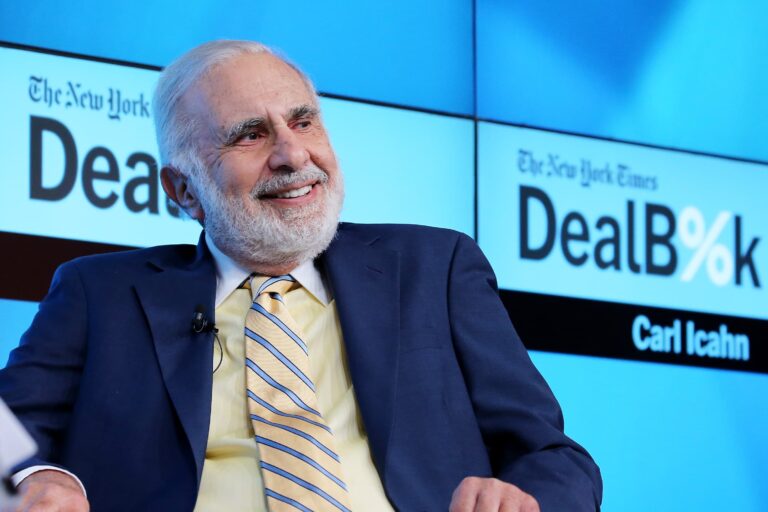

Shareholder activism, while often underrecognized, is an important part of the complex machinery of the financial markets. But what exactly is activist investing, and who does it? Read on to learn about activist investors and how to turn your knowledge about them into profits in your own portfolio.

Traditional business lenders are often reluctant to fund new startups with unproven ideas. Equity crowdfunding is often the best option for cash-strapped entrepreneurs who can’t afford to finance their projects by other means. Learn how equity crowdfunding works and the pros and cons of using it.

Too many 20-somethings chase higher incomes with no clear endgame — and spend every penny along the way, entering their 30s with no financial assets to show for it. Make these smart financial moves in your 20s and you’ll find better footing in every area of your life, not just your finances.

If you dream of building wealth, you need to start with the habits that will get you there. With each good money habit you form, you pick up more momentum on the road to wealth. Here are 16 good money habits you can begin to form today.

Investors have their own language. When you decide to start investing, it’s best to learn the lingo as quickly as possible to help you understand market news and analysis. Learn to speak the language of investing with this glossary of terms every investor needs to know.

Too many high earners confuse income with wealth. But the trappings of wealth are not the same as wealth itself. These 15 common mistakes made by six-figure earners prevent them from accumulating permanent wealth.

M1 Finance and Wealthfront both offer low- or no-cost automated investing platforms and spending accounts, but their features will appeal to different users. Both offer sophisticated investing algorithms and a mix of prebuilt portfolios and low-cost ETFs. Which is best for you? Learn more here.

The almighty dollar can cause us more stress than work, family, and even our health, often because we spend too much and save too little — or nothing at all. Learn why you should maintain three types of savings — emergency, retirement, and personal savings — and how much you should save for each.

“Should I invest or pay off debts first?” It’s a question that challenges the masses. For most people, the answer is a mix of aggressively paying off high-interest debt, making minimum payments on other debts, then reallocating the funds to tap into the market. Find out how to do it here.

Real estate is not only an income-oriented investment, it’s also a less volatile asset class than stocks. Here are ways you can invest in real estate to start diversifying your passive income immediately.