Reviews

12 articles

You can still find free checking accounts these days if you know where to look, but truly free checking accounts are in short supply at big banks like Wells Fargo and Chase. So the fact that the Chase Total Checking® makes it relatively easy to waive its $12 monthly maintenance fee counts as a win.

If you’re looking for a reliable savings account with a very competitive yield and full deposit insurance, it’s worth a close look. However, it has some important shortcomings and isn’t available in all areas, so it might not be the best option for you.

The Capital One Platinum Credit Card is a no-frills, no-annual-fee credit card designed for consumers who wish to build their credit. Although it’s not a secured credit card and thus doesn’t require an upfront deposit, it has a fairly high regular APR and comes with a low initial credit limit. However, when used responsibly, Capital One Platinum

Capital One Spark Cash Select for Good Credit is a popular business cash back credit card with no annual fee and a simple rewards program that earns an unlimited 1.5% cash back on every purchase. Like many other business credit cards, it offers some useful benefits for business owners, such as free employee cards and

The Capital One SavorOne Rewards for Students card is a student credit card with a generous cash-back rewards program and relaxed underwriting standards, making it an appropriate choice for students of many stripes. Learn whether the Capital One SavorOne Rewards for Students card is right for you.

The Chase Freedom Flex Credit Card improves on its popular predecessor, the original Chase Freedom card, with expanded cash-back opportunities, an excellent sign-up bonus and 0% APR purchase promotion for new cardholders, and valuable fringe benefits. Find out if this card is right for here.

Wealthfront was one of the first robo-advisor platforms to break into the retail investing mainstream and remains a popular choice today thanks to its low cost and well-rounded services. Read on to familiarize yourself with what Wealthfront is all about and how it stands apart from the competition.

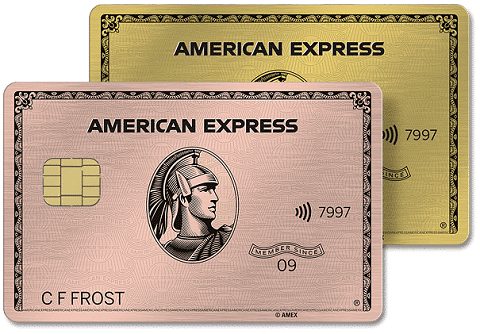

The American Express® Gold Card is an exclusive card with a $250 annual fee and no preset spending limit. It features a generous rewards program built around travel and everyday expenses. The catch, of course, is that this card is reserved for people with truly excellent credit, and thus isn’t appropriate for first-timers or those

Capital One Spark 1.5X Miles Select (also known as Capital One Spark Miles Select for Business, or simply Spark Miles Select) is a business credit card with no annual fee and a straightforward travel rewards program that accrues miles on every purchase. Miles can then be redeemed for virtually any type of travel purchase, including

InboxDollars is a straightforward way to earn discounts and cash online. With free premium membership and a multitude of saving and earning opportunities, it won’t make you rich, but it could net you some extra spending money. Learn more about it here.

Sign up for Zipcar and get a FREE $25 driving credit. Zipcar offers city-dwellers a viable alternative to traditional car ownership. Its hundreds of hubs around the globe make it one of the world’s largest carsharing companies, and once you have a membership you can use its vehicles anywhere – including Europe. Like the locally based nonprofits

With a presence in 10,000 cities around the world, Uber is the world’s most popular ridesharing app. Like the Lyft app, it lets riders hail drivers electronically and compensate them for their services by credit card. The Uber app offers access to several different levels of service, from cut-rate options (UberX and UberPool) to luxury