Reviews

12 articles

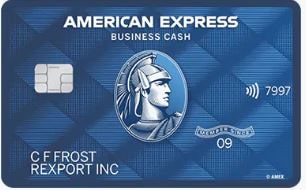

The American Express Blue Business Cash™ Card is a popular business credit card with no annual fee and a solid cash back rewards program that rewards business owners for everyday purchases they’d make anyway. With no annual fee, it works well as a general-purpose business credit card, and its 12-month, 0% on-going APR promotion is

Everyone wants to earn extra money, and most people like sharing their opinions. That’s why survey sites like Ipsos iSay are so popular. Find out how to increase your side income while shaping the products and services you use every day.

As sharing economy gigs go, shopping for a grocery delivery service like Instacart is a pretty good deal. Instacart classifies in-store shoppers as traditional employees, guaranteeing them a base wage and legal rights. Learn the pros and cons of becoming an Instacart shopper and how to apply.

If you’re searching for a remote job or flexible work arrangement, FlexJobs is one of the most efficient job boards you can use. It offers high-quality postings but also carries a cost. Would FlexJobs be worth it for you? Learn about FlexJobs, its features, pricing, and benefits for job seekers.

Upstart is a versatile lender that serves a wide range of borrower types and takes a refreshingly inclusive approach to underwriting, although it’s not appropriate for applicants with impaired credit. Learn more about Upstart and find out whether this lending solution might be right for your needs.

Unlock effortless savings with the PayPal Cashback Mastercard®. With no annual fee, you’ll earn up to 3% back on PayPal purchases and 1.5% back on all other eligible purchases. Your rewards accrue daily, ready to be redeemed at your convenience, with no minimum threshold. Experience a card that pays you back for your regular spending.

Credit Sesame is a feature-rich consumer finance tool that delivers credit scores and reports, identity theft protection, and a user-friendly cash management account with a Mastercard debit card and a host of benefits. Read on to learn whether a free or paid Credit Sesame plan is a good fit for you.

Wismo Budget is a lightweight mobile budgeting app that can save busy users from the drudgery of spreadsheets and graphs. It also has a social component that lets you see how you stack up to your peers. But can it match competitors like Mint and MoneyPatrol? Find out now.

Choosing a small-business checking account can quickly get overwhelming. It’s not always clear which features add value and which serve mainly to confuse, and many accounts come with frustrating transaction restrictions that can really bite as your business grows. So for many small-business owners and independent professionals, simpler is better. LendingClub Bank seems to agree.

Tally helps people with good credit scores consolidate high-interest credit card debt to save money in the long run — as long as you qualify and can maintain good financial habits in the future. Learn about Tally’s approach to credit card debt consolidation and find out whether it’s right for you.

Update: Effective January 1st, 2024, Mint is no longer available. Intuit encourages Mint users to open a free Credit Karma account to access some of the financial tools previously offered by Mint. How do you manage your personal budget? Perhaps you’re a fan of old-fashioned envelope budgeting. Maybe you use computer spreadsheets to track your income and

Aura’s identity theft protection services offer a well-rounded solution for the detection of fraud in the digital world. With lightning fast alerts, digital life monitoring and protection, and identity and financial protection insurance, it’s everything you need to stay safe online.